HOW TO TAX DECLARE YOUR P2X INCOME

P2P & P2B Tax Reports

| P2P | Real Estate | P2B |

|---|---|---|

| Bondora | Bergfürst | Crowdestor |

| Debitum Network | BitOfProperty | Ecoligo |

| DoFinance | EstateGuru | Monethera |

| FastInvest | EvoEstate | Wisefund |

| Grupeer | Exporo | Seedmatch |

| Mintos | Housers | |

| PeerBerry | Rendity | |

| Swaper | Zinsbaustein | |

| ViaInvest | Zinsland | |

| ViVentor |

Investing into Peer-To-Peer (P2P) or Peer-to-Business (P2B) loans allows you to gain passive income from interest rates.

Based on your personal taxation situation you might be required to report these incomes with your tax statement. Below you find step-by-step instructions to get the necessary tax information for common platforms.

Several platforms have improved tax reporting in 2020 by providing a dedicated function for us investors.

I'm not a tax professional nor an investment professional. The information I share are common sense, based on my experience and not to be considered as professional services. Please make your own risk assessment and consult professionals in the related area.

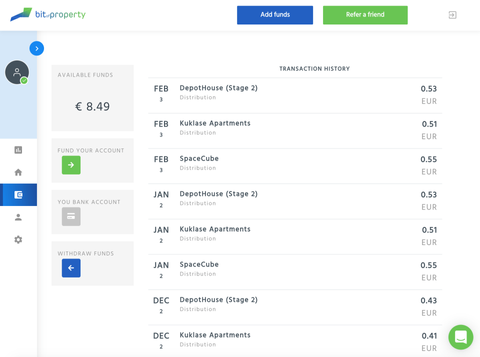

BitOfProperty

BitOfProperty only provides a web-view of the interest income under "Wallet". You can use the browser's print function to create a PDF document. Still you have to manually calculate the total amount of profit gained and add it to your tax report.

Steps:

1. Login to your BitOfProperty account

2. Click "Wallet" in the left-hand navigation bar

3. Print the web-page as a PDF document

4. Calculate the total amount for the interest gained manually for the relevant taxation time frame.

Bondora

Bondora offers an out-of-the-box tax report as PDF download that you can generate under "Reports".

Steps:

1. Login to your Bondora account

2. Click "Reports" in the left-hand navigation bar

3. Click "Create new report" button

4. Check the "Tax report" option and specify the timeframe

5. Click "Create the report" button

6. Wait until the document creation process finished

7. Click the document icon to open/download the tax report

The generated report is permanently available under "Reports".

Crowdestor

Crowdestor provides a PDF-report that you can generate under "Transactions". It lists each interest income you received for the specified timeframe.

Use the Excel-export function to calculate the total amount, which is not contained in the PDF-report.

Steps:

1. Login to your Crowdestor account

2. Click "Transactions" in the left-hand navigation bar

3. Specify the timeframe

4. Under "Transaction type" select "Interest Payment for project"

4. Click "Filter" button

5. Click "PDF" / "Excel" button

6. Open the generated and downloaded PDF file

Debitum Network

Debitum Network provides an export function for your account balance given a specific timeframe. The generated Excel document states the income gained from business loan interest.

Steps:

1. Login to your Debitum Network account

2. Click "My balance"

3. Select the date range

4. Click "Create document"

5. Download generated Excel document

DoFinance

DoFinance provides a PDF or Excel export containing the profits gained.

Steps:

1. Login to your DoFinance account

2. Click "Transactions" from the menu

3. Select the data range

4. Click "Transaction Type" and select "Profit" only

5. Click "PDF Download"

The document lists single transactions and states the total profit amount.

No referral promotion currently available.

Ecoligo

Ecoligo provides a PDF export function for the interest income of a given date period.

Steps:

1. Login to your ecoligo account

2. Click "Mein Konto" in the main navigation

3. Click "Steuerdokumente" in the side navigation

4. Select the tax year

4. Click the "Herunterladen" button

EstateGuru

EstateGuru provides a link that generates a PDF report for the previous year.

Steps:

1. Login to your EstateGuru account

2. Click "Account balance" in the navigation

3. Under section "Reports", tab "Income statement" click the link "Previous year"

4. The PDF document is immediately created and downloaded

The generated report contains the relevant accumulated interest amount.

FastInvest

FastInvest offers an out-of-the-box tax report as PDF download that you can generate under "Statistics".

Steps:

1. Login to your FastInvest account

2. Click "Statistics" in the side navigation

3. Scroll to the "Income Statement" section

4. Select the tax year and click "Export to PDF"

5. Wait until the document is generated

6. Click the "Download" button

The generated report is permanently available under "Statistics".

Grupeer

Grupeer provides a button that allows generating an income statement PDF report for the given date period.

Steps:

1. Login to your Grupeer account

2. At the "Overview" click the button "Income statement"

3. Specify the timeframe

4. Click "Download"

The generated report contains the relevant accumulated interest amount.

Housers

Housers allows to generate a fiscal year report as PDF document.

Steps:

1. Login to your Housers account

2. Click "Documents & Repots" in the side navigation

3. In section "Fiscal Reports" select the year

4. Click the "Enter" button

5. Click the "Download" button for the available report

Housers keeps 19% taxes of the interest profits for investors that are not based in Spain. Additionally they keep a withhold and also an expense fee.

Report these details in your tax statement.

Mintos

Mintos offers a dedicated function to create a country specific tax report that then will be send to your e-mail address.

Steps:

1. Login to your Mintos account

2. Click your name in the header navigation and then "My account"

3. Click "Tax report" in the left-hand navigation

4. Select the country

5. Specify the time frame

6. Click "Submit" button

7. Check your e-mail account for the profit statement e-mail from Mintos.

The e-mail content itself is the report. It does not contain a file attachment.

Monethera

Monethera provides a PDF export function for the interest income of a given date period.

Steps:

1. Login to your Monethera account

2. Click "Statements" in the main navigation

3. Specify the date period

4. Click the "PDF" button

PeerBerry

PeerBerry offers a dedicated function to create a tax report as PDF document.

Steps:

1. Login to your PeerBerry account

2. Click "Statements" in the header navigation

3. Scroll down to section "Tax Statement"

4. Specify the date period

5. Click button "Generate"

6. Click "Download" in the table below showing the new generated PDF

The generated PDF document will still be available after the download.

No referral promotion currently available.

Swaper

Swaper offers a dedicated function to create a tax report as PDF document.

Steps:

1. Login to your Swaper account

2. Click "My Profile" in the header navigation

3. Click "Income Statement" in the sub-header navigation

3. Select the tax year and verify date period is correct

4. Click button "Download statement"

No referral promotion currently available.

ViaInvest

ViaInvest offers a dedicated function to create a tax report as PDF document.

Steps:

1. Login to your ViaInvest account

2. Click "Statement" in the header navigation

3. Under section "Tax Summary" select year "2019"

4. Click "Download PDF"

The document contains the interest profit per ViaInvest's legal entity operating in the specific country. You need to sum these up to get the total amount.

ViVentor

ViVentor offers a dedicated function to create a tax report as PDF document.

Steps:

1. Login to your ViVentor account

2. Click "Account Statement" in the header navigation

3. Specify the date period; no need to specify "Payment Type"

4. Click button "Tax Report"

Wisefund

Wisefund provides an one-click function to download a PDF document for the tax report.

Steps:

1. Login to your Wisefund account

2. Click "Statistics" in the main navigation

3. Click "Download tax statement"

4. Select the provided year